Arctiq Volatility

Basics

“From zero to one! Don’t underestimate one, it has the capacity to scale to infinity. Welcome to the Beginner’s Oasis!”

Let’s consider this article as number Zero. Not in the sense that it has zero value (hopefully), but rather as a starting point. Every object remain at rest or in uniform motion in a straight line unless compelled to change it’s state by the action of an external force. I want to create that force for you, so you can start moving or change your direction into a new unexplored world. The world of Options.

Answering a question, “Why?”, could create such a force. So why options? I imagine my target reader as someone who has been investing in a stock market, maybe bonds. With some or no knowledge of derivatives.

Imagine (maybe I will draw a sketch on tablet to represent the idea of 2D ant walking his path) you are an ant freely walking along a vertical line, up and down, like a price of a stock. And there is a another line that runs from left to right, time, combining those two lines our little ant can move freely up and down and as the time goes his path is drawn like a chart of a stock price. It is a beautiful but yet simple life on a plane. One day the ant comes across something new, an option contract, “could be some metaphor for something, maybe a glasses and he sees now things he has never seen before”, as he keeps wonder there is a valley, mountains and hills. The options provide a new dimension. In the ants world are now depths of valleys and heights of mountains. Options allow to take an advantage of that new dimension.

What is the purpose or reason for this website? My intention is to show you places I have discovered, walk you thru my valleys and mountains, but only in a hope that you will learn the tools and skills necessary to explore the depths of oceans and heights of mountains safely on your own. Options trading is very much individual activity, and as you can follow someone for some time, eventually everyone will deviate and became explorer for yourself with your own path. And that’s the goal. Give you confidence being able to safely navigate thru financial markets on your own.

What do I need? You may ask. Knowledge of advanced Calculus, Stochastic processes, Probability and statistics, 6 years experience in using Monte Carlo methods, Differential equations, Economics, programming in Python or R at least 4x 21inch screens, super fast internet connection…ehm not really…a Ph.D. in applied financial Mathematics is definitely a plus, but not mandatory. You see, the individualism goes this way too. Options trading can be relatively simple or hardcore science, depends how far you want to go.

So to answer the question from the begging of the paragraph. You need, a computer with connection to the internet, an account with a broker who can buy and sell options, stocks and other financial instruments for you. There is going to be an article about broker and their online platforms.

Before diving into the beauty and science of options, we need to talk! Talk about the basic terminology. The aspiring options trader must grasp and fully absorb the basic terminology, definitions and principles associated with such trades. Understanding these fundamentals is an absolute prerequisite for the further successful development of an options trader. I will provide basic concepts in their general definition, intending to thoroughly analyse each term not only from a theoretical but especially from a practical perspective in the upcoming articles.

Options are so called derivatives, meaning their price is derived from an underlying asset, such as stocks, commodity, ETFs, futures, bonds, currency, etc. (The impact of the underlying price on the option price will be discussed in the article on Option pricing).

So what terms should everyone understand?

- Underlying – refers to an asset on which the option is based.

- Call option – a contract to buy a specified quantity of the underlying at a specified price within a specified time.

- Put option – a contract to sell a specified quantity of the underlying at a specified price within a specified time.

- Long – a long position profit from an increase in value.

- Short – a short position profit from a decrease in value.

- Strike price – the specified price at which an option contract is listed.

- Expiration – the date on which the option contract ceases to exist.

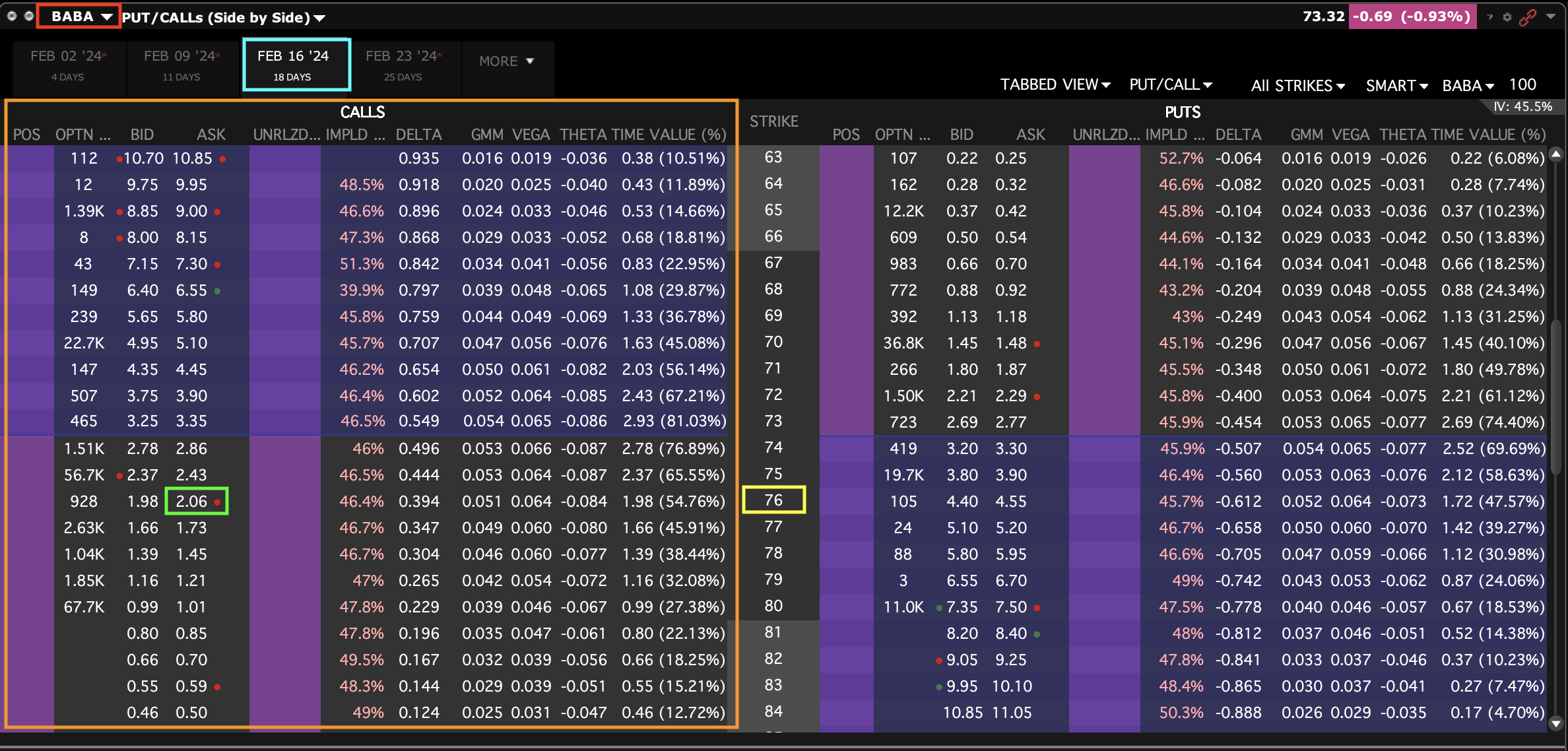

- Option Chain – a table of the options listed on a specific asset across the strike prices (see the picture below).

- Moneyness – the relative position of the strike price to the underlying price OTM, ATM, ITM (more on that will be discussed in the Extrinsic/ Intrinsic article.

The specified time is determined by the expiration date of the option contract, until then the specific time period runs. The specified price refers to the value of the strike price in the option contract and the specific underlying asset is a security or asset that is the subject of the option contract.

See the colour-coded rectangles in the picture below for easy orientation. If you purchased a Call option (the left side of the Option chain, marked by the orange rectangle), with an expiration date of Feb 02, 2024 (highlighted in blue) on the underlying asset BABA (Alibaba, spotted in red) and it’s strike price of 76 (that’s the yellow rectangle), it means that, within a specific period (until the expiration date Feb 02, 2024), you have the right to buy the specific underlying asset at specified quantity, (100 shares of BABA) at a specific price (76 USD, the strike price).

You may have noticed another rectangle I didn’t mentioned, the green one. It marks the ASK price, indicating the price at which the Call option with a strike price of 76 was available to buy at the moment I took the screenshot. I will talk about ASK and BID prices in the Extrinsic/ Intrinsic article.

So this type of option we “purchased” is considered “American” because the holder can exercise the right at any time before the end of expiration. If the right could only be exercised on the expiration day, it would be a “European type” option. The type is not determined by region, instead, it depends on whether the right holder can exercise the option at any time before expiration or not. Generally speaking, American options are based on ETFs and stocks, while European options are based on indexes. Here, we are going to focus on American options as they provide more flexibility.

Options traded on regular options exchanges are called “Listed Options.” The options contracts are standardised, one option contract represent 100 shares of the underlying asset. For one underlying asset, options can be traded on several different exchanges. The prices of such options, represented by their bid and ask prices, can be observed on all options platforms. These platforms provide a view of an option chain, which displays individual option contracts across different strikes and expiration periods in an organised format. This view not only shows the prices but also other essential values such as open interest, volume, implied volatility, “Greeks” and various data that option trades may find useful for their trading.

Opposed to Listed options, there is an OTC (Over The Counter) market for options. It is a decentralised marketplace where options are traded directly between two parties without a centralised exchange. In this market, buyers and sellers negotiate and customise the terms of the options contract, such as the strike price, expiration date contract size etc. OTC options are not standardised and lack the transparency of options traded on organised exchanges. The parties involved in OTC options transactions are typically institutional investors, banks and other financial institutions.

Get in touch

Questions, comments, or a business proposition? I am always up for meaningful dialogue and exploration of potential opportunities.